The Buyer Intent Playbook: How to Make the Most of Intent Data

Quick - jot down everything you know about your prospective buyers.

Looking for a crash course in all things G2 Buyer Intent?

You’re in the right place! Join us as we embark on a seven-book journey to understand and operationalize your G2 Buyer Intent. Want to click ahead to one of the seven books below? Use the sidebar to navigate ahead, back, and between books at your leisure!

Now, let’s pick up the first book and get started.

You’ll need to have close alliances and relationships to accomplish your goals with Buyer Intent.

Before you ever start building lists, setting up notifications, or creating campaigns – you must first enroll your team members who lead revenue operations efforts. These include your marketing, sales, or revenue operations manager(s). The earlier you align and get buy-in from the ops side of your org, the sooner you’ll get processes in place to make G2 Buyer Intent easily accessible to drive SDR, sales, and CSM efforts – and run stronger marketing campaigns.

Still not convinced that you should finish this book? Your revenue operations squad can help you:

Not only can your rev ops team act as a sounding board for potential new ideas to use these signals (and ensure they’re realistic), they can also help you think through the nitty gritty processes and list details to ensure your initiatives are set up correctly, are more efficient, and can be effectively reported on.

Rev ops’ involvement will be necessary to nail G2 Buyer Intent’s most important prep step: making your buyer intent signals accessible in real-time to sales and marketing tools and teams. You might be getting a ton of companies coming to your G2.com Profile or Category pages, but if they aren’t available to easily see/use, you’ll end up turning your wheels and missing the opportunity to engage with in-market buyers.

Want to get your rev ops teammate(s) excited about the addition of G2 Buyer Intent?

Let your rev ops team know you have access to engaged companies from G2 Buyer Intent. Encourage them to log in to my.G2 to get a glimpse of the signals you’ve received in the last month, 6 months, and 12 months. This quick look will provide you the data you need to explain why this project needs to be prioritized, and what the opportunity for your sales and marketing teams will be.

Rev ops can help you set up processes to drive data accuracy, effectiveness, and efficiently. And with a rev ops team member in your corner, you’ll have confidence in the campaigns, cadences, and processes you want to set up.

Now that we’ve established long-lasting friendships and reliable allies, it’s time to find out what’s hiding in your G2 Buyer Intent signals – and what it actually means for you! It’s going to be a lot easier to decide on the actions you want your marketing campaigns or SDRs to take if you know exactly what each signal means and what it could indicate.

Keep in mind that while individuals are visiting your page, you can only receive Buyer Intent signals for companies. Get familiar with each of the signals in the table below.

|

G2 Buyer Intent Glossary: What am I seeing? |

|

|

G2 Profile Visit |

A Buyer who visited your G2 Profile page |

|

Sponsored Content Visit |

A Buyer who viewed your Sponsored Content on a competitor profile on G2.com |

|

Category Visit |

A Buyer who visited your category page (the name of the category will be available if you’re in multiple) |

|

Alternatives Visit |

A Buyer who visited an Alternatives page for someone in your category, where you were listed as one of the alternative options (the name of the competitor is available in the data) |

|

Comparison Visit |

A Buyer who ran a comparison between your product and up to four other products |

Want these descriptions easily accessible to you and your teammates? Print out and share this reference sheet.

Now that you know the signals you’ll encounter, let’s explore how they’re related to the marketing funnel and other indicators that might enhance how you interpret these signals.

There are some firmographic and technographic data points that could change the meaning of a buyer intent signal. Here are five key considerations to keep in mind when building out your plans.

Why is this additional information important? This data already helps you assign accounts and gives your teams guidance on how to treat a prospect or customer. This data, overlaid with G2 Buyer Intent, gives your teams a clearer picture of where exactly a prospect or customer might be in their decision-making process.

To keep this exercise simple, we’ve used HubSpot’s flywheel framework when referencing parts of the buying cycle:

We’ve outlined how you could read these signals, based on the intent signal type and where a customer is in the buying cycle, shown below. Depending on your industry and customer type, intent signals can have different meanings. These are general interpretations we’ve found likely, based on other G2 users.

|

Attract: Strangers |

Engage: Prospects (Open Opps) |

Delight: Customers |

|

|

G2 Profile Visit |

|

This buyer might be gathering additional info, checking reviews on your product, or verifying your conversations. |

This buyer might be deciding whether to write a review, or they might be curious about the sentiment other users might have toward your solution. |

|

Sponsored Content Visit |

|

This buyer is probably doing their due diligence across all vendors they’re considering. |

Your customer could be evaluating alternatives during your renewal period and might have a better handle on the competitive landscape as a result. This could also indicate they have a shortlist of providers they’re considering. |

|

Category Visit |

|

This buyer might be doing some due diligence, which may indicate that they aren’t completely sold on your product and are exploring alternatives. |

This buyer could be looking at where you rank within your category for validation. |

|

Alternatives Visit |

|

Are they looking at one of your competitors’ Alternatives pages? You might not be the only horse in the race. Are they looking at your Alternatives page? This could mean you haven’t met their criteria and they’re looking for other options to consider. |

Are they looking at your Alternatives page? This could mean they’re unhappy and are considering switching to a new solution. |

|

Comparison Visit |

|

The vendors they choose to compare you to are strong indicators of your direct competition for their business. |

A comparison against you and competitor(s) provides intel into who might threaten your ability to renew this account. |

Want these interpretations easily accessible to your SDRs, sales team, and CSMs? Print this table out and share it!

There are a variety of different options and paths you can take when it comes to what signals to focus on. We’re to help you make sense of these signals relevant to your business and your teams.

Want to discuss the place G2 Buyer Intent has in your marketing and sales strategies? Here's an agenda for a workshopping session you can conduct with your project stakeholders:

Congrats! You’ve completed Book 2! Now you’ve got a handle on what you’re working with and you’re aligned with the teams that are going to support you. Well done. You’ve got some go-to materials to reference throughout the rest of the plan and share with your sales team for enablement, too!

It’s time to think about our Ideal Client Profile! Ask rev ops or your product marketer for a quick outline of your ICP and keep it handy. You’ll need it for the next few books.

This will help you ensure the Buyer Intent signals you’re focusing on are the highest quality for your sales team to close. You might be getting intent signals from companies you don’t pursue, we don’t want you (or your teams) focused on those. Having your ICP readily available will make it easier to implement processes that keep your data in tip-top shape, and keep your initiatives honed in on the right prospects.

Take a moment and outline who your ICP is from a company standpoint:

And who specifically at these companies is your ideal target contact?

During this stage, ask your rev ops team if you have a specific tool for contact information tools you use. These commonly include vendors like ZoomInfo, Clearbit, or Cognism. G2 can provide you with the company names and locations, but we don’t reveal contact-specific info.

We’re going to create list descriptions based on our target goals and buying stage, all to help us remain focused. Outline your specific target audiences to make developing marketing strategies, content, and cadences far easier. Use this template to outline your lists.

For the example: We showed an option for our users on G2’s Pro package and one for G2 Power package users – all based on KC’s goals and needs.

|

Pro Possibilities |

Power Possibilities |

|

Focus on one competitor. Parameters:

|

Focus on one competitor.

|

|

Focus on them all. Parameters:

|

Focus on them all.

|

There are a ton of lists you can create based on your specific marketing strategies and goals. Think about the audiences that you see the most success in, and think of Buyer Intent as an enhancement to your current audiences.

Do you have an issue with even getting considered at the beginning of a buyer’s journey, like KC’s roster management? Are you overshadowed by a specific competitor that you know you blow out of the water on head-to-head comparisons? Think about all of these questions and use the signals to craft hyper-relevant audiences!

Alright! Book three’s now in the books. By now you’ve squared away the most valuable parts of G2 Buyer Intent, the audiences you’ll want to focus on, and the goals you’re striving toward. Now, we’re going to define what you want to say to this audience, and how exactly you’re going to reach them.

When you think of G2 Buyer Intent, you’re probably jumping to thoughts and dreams like:

These are great thoughts to noodle on. But before you can really capitalize on the signals you’re receiving, you have to figure out what exactly you’re going to say to these people. You can’t write email messages with snippets like: “We saw that you compared us to our arch nemesis on G2. Let’s talk’.”

Or perhaps you don’t want your SDR speaking to a prospect saying: ‘I know you’re considering us as a potential vendor because you keep visiting our G2 Profile page.’ For the sake of your prospects’ first impression of you, these details really matter.

This is why you need to make sure you spend time looking at your messaging and content to align it with the audiences you’re targeting.

Over the last three books, you’ve set yourself up to come away from this step with a pretty good idea of the messaging you’ll need to arm your sales and marketing teams with and whether there’s any additional content you need to create.

Feel free to use the same process you use to develop content for other marketing programs! Again, no need to recreate the wheel. Simply leverage the lists you created in the last book, paired with your marketing goals and the area of the cycle you want to focus on.

From there, spend some time outlining:

Don’t have a content development process? No worries! Here are a few pointers to guide you:

Now that you know what you’ll say to your G2 Buyer Intent audiences and what content you already have access to leverage, your mind might be spinning with all the possible campaigns you could set up. Along with how to get these signals into the hands of your sales teams ASAP.

Before you close this book, identify assets you don’t currently have that must be created to run a successful campaign or enroll the SDR teams. Try to focus on must-have assets rather than nice-to-have right now.

Some content considerations to cover all of your bases:

This is the place to get creative! Depending on your bandwidth, your content can be as simple as talking points and email messages or advanced as new hyper-focused landing pages or relevant whitepapers.

If you need some inspiration for top of the funnel, bottom of the funnel, and follow up emails, check out these templates.

At the end of the day, the goal of this book is to ensure you’re able to provide prospects and customers with the relevant information they need (and expect). The faster they can find the info they’re searching for, the faster they’ll make a decision.

You’ve gone through the steps, and your G2 Buyer Intent strategy is coming to life. You’ve got an aligned team, audience framework, and relevant messaging – but your sales and marketing teams are still raising eyebrows. All of these activities mean nothing to your teams if they can’t see it in their go-to tools. Book five is all about making your Buyer Intent accessible and REAL to the people who will be using it.

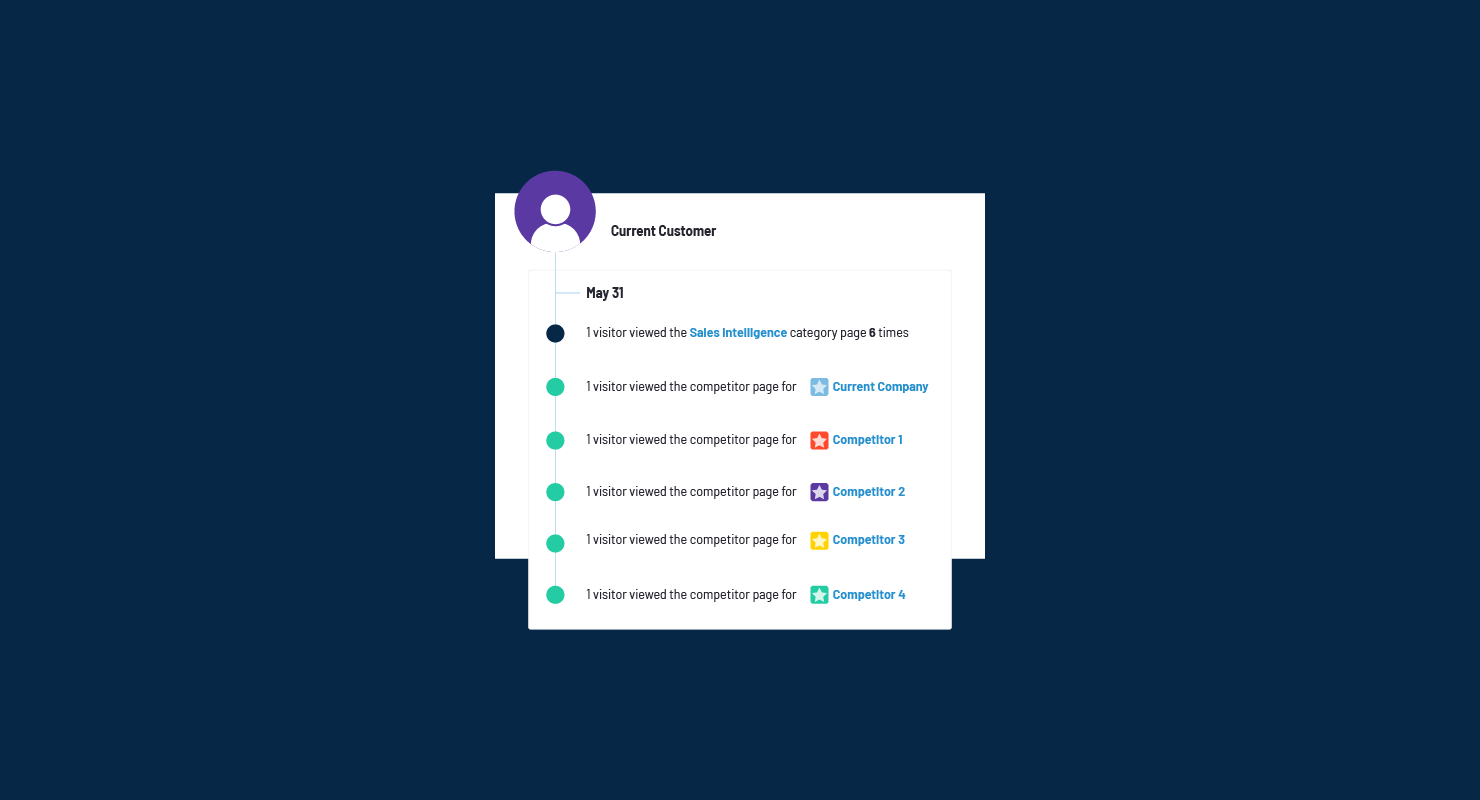

If you log in to my.G2 and go to Buyer Activity, you can see a full list of the companies who have been visiting you, your category pages, your competitor pages, and more. But how do you make this information automatically accessible to your sales and marketing teams? You don’t want to depend on your teams to log into another tool. You have to make it easy for them by putting it all in the tools they trust most.

Enter: THE INTEGRATION HUB

This is the step where rev ops can really shine. They’ll know what makes sense for your current data ingestion processes, and any barriers or considerations that need to be resolved before you integrate G2 Buyer Intent into your systems.

We recommend our customers set up and use at least one of our integrations. Below is an overview of our partners who automatically integrate Buyer Intent into their systems. With your rev ops squad, highlight the tools you currently work with in this checklist. Secondly, prioritize those tools that are most important to have Buyer Intent data available. Once you’ve identified the tools you want to have Buyer Intent available in, reach out to your G2 rep to have these integrations quickly set up.

In this section, it also makes sense to review your ICP and ensure these parameters are taken into account when you’re integrating your systems to make sure your data stays clean, relevant, and accurate.

We’ve made it to the penultimate book, which means it's time to bring it all together. How do all of these pieces and story lines come together? We’re about to find out...

Based on your goals and focuses, you might only care about having a specific team use these signals, you’ve documented this back in Book Two when you prioritized the stages of the buying cycle. You can come back later and add new audiences and messaging using your established processes.

Below are options to use if you’re using this information for marketing programs, SDR campaigns, sales outreach, or CS support.

Let’s decide how you’ll reach your target audiences.

Don’t recreate the wheel, enhance it Do you already have a ton of marketing campaigns, launches, or content releases planned? The easiest way to leverage G2 Buyer Intent is to leverage the lists you’ve defined previously and add these new companies into current initiatives you’re running.

BONUS: A/B test a currently-running retargeting campaign or email nurture with the list of G2 Buyer Intent companies versus your standard lists.

Spend some time with your team, and outline all of the campaigns and channels you’re currently investing in. ee where you can use these G2 Buyer Intent audiences without requiring additional work from your team.

Build a new campaign the same way you do any of your current r campaigns. Below are a few channels to consider for a holistic approach. However, your channels are going to be dependent on the content you already have, and the content you're able to develop. The good news? You already have a messaging guide and list of assets that are at your disposal thanks to an earlier book!

We’ll provide you with some ideas to get your mind going, but feel free to have fun with this and think outside of the box with a fun campaign!

G2 users have created automated email campaigns with one or more emails that are triggered whenever a new Buyer Intent signal has been identified.

Think about what your audience is looking for and give it to them!

If you’re using the LinkedIn Matched Audiences integration, you can set up retargeting efforts with direct access to your Buyer Intent signals.

What should you do for content?

If you don’t have a G2 Content license yet, no worries! You can still highlight your standing on G2:

Use the social campaigns or retargeting strategies you already have implemented, and fuse your G2 Buyer Intent into them!

The same rules we just discussed above with your social channels very much apply to your ad channels. the same process you use to set these campaigns up, and simply point them at the audiences built from G2 Buyer Intent.

Similarly, if you’re licensing G2 Content, offer access to it in your CTA. Or highlight your category position, a badge you’ve won, or your placement on a Best Software list.

For Sales, there are several ways to help them take action on your company’s Buyer Intent signals efficiently, and in real-time.

One of the biggest (and quickest) wins you can do is get these companies in the hands of your SDR teams to start working. If you’re using a tool like SalesLoft, make sure you leverage our integration. Your SDRs will have access to Buyer Intent data within the tool and you can support your teams with cadence templates, relevant to different audiences and intent signals.

You can also set up alerts within Salesforce for your team, or direct notifications within my.G2 to notify your reps when a company engages with G2.com in real time. If you’ve been following us through this whole journey, you likely have talking points ready for your teams to leverage. Now it’s just a matter of infusing what they’re currently doing with new access to G2 Buyer Intent accounts!

For sales teams that are currently working deals, make sure they’re getting notified when a deal they’re working is having any kind of behavior on G2. This is the kind of context that can make or break a deal, allowing them to refocus and nail the timing of their outreach – all thanks to the G2 Buyer Intent signals their accounts are giving off. You can set this up through my.G2, or through an integration like HubSpot or Salesforce.

For late-stage deal support, give them access to your G2 Content. So they can share reports and key comparative data to get their stakeholders across the finish line.

Here are some ways to align Buyer Intent signals with G2 Content when prospects are in the ‘Engage’ buying stage.

|

G2 Buyer Intent Glossary: What am I seeing? |

|||

|

Signal |

Description |

What it might indicate |

G2 Content to use! |

|

G2 Profile Visit |

A buyer who visited G2.com and visited your Profile page. |

This buyer might be gathering additional info on you, and verifying your conversations and checking reviews. |

|

|

Sponsored Content Visit |

A buyer who viewed your Sponsored Content on a competitor profile on G2.com. |

This buyer is probably doing due diligence across all of the vendors they’re evaluating. |

|

|

Category Visit |

A buyer who visited your category page. (The name of the category is available if you’re in multiple categories) |

This buyer might be double-checking their research and evaluation findings. They could even be making sure there isn’t anyone they’ve forgotten to speak to. This could also indicate that they were completely sold during your conversations that you were the top choice. |

|

|

Alternatives Visit |

A buyer who visited a G2 Alternatives page for someone in your category, where you were listed as one of the alternative options. The name of the competitor is available in the data. |

Are they looking at one of your competitors’ Alternatives page? They might be looking to identify additional vendors to contact. Are they looking at your Alternatives page? This could mean you haven’t met their criteria and they’re evaluating other options. |

|

|

Comparison Visit |

A buyer ran a comparison between your product to up to four other products. |

This buyer is directly comparing you to other options they’re considering. The vendors they choose to compare you to are strong indicators of your direct competition in this deal. |

G2 Compare Report |

The good news is any of the G2 Content types we’ve covered here are useful in the middle of a deal. They provide your reps with accessibility to third-party, objective data to help your prospects make a decision.

When you know what your customers and prospects are interested in, you can do the homework for them and step in as the hero to get them the resources they need to make a confident decision quickly.

You’ve made it to the last book of Buyer Intent Witchcraft and Wizardry! Congrats! You Harry Potter fans out there can recall the emotional rollercoaster this book took us on. It might be the same feeling you get when you think about the measuring success of your programs.

But fear not! We’ve got you covered with recommendations on how to measure your G2 Buyer Intent ROI.

Depending on how your team currently measures success, your approach to measurement and attribution might be different than what we outline below. We’ve provided some considerations for your team to think about as you decide how to measure the G2 Buyer Intent based on the plays your teams are running.

But what should you measure and track? Even if your teams measure first touch or last touch attribution, don’t overlook a metric like influence.

Here are some metrics you might want to track for SDR efforts:

Some specific metrics you might want to track for pipeline and revenue:

Some specific metrics you might want to track for customer success:

Some specific metrics you might want to track for marketing ops:

Some specific metrics for demand generation and digital marketing to track campaigns:

Use the frameworks you already have in place, and A/B test your campaigns and messaging to identify significant correlations!

If you can only focus on a couple metrics, we encourage you to work with your rev ops team to build a report that shows closed-won revenue influenced by at least one G2 touchpoint, and your win rate with those deals. This will paint you a clear picture G2 ROI to make renewal conversations easier and more quantitative..

Want to get really specific? You can break down these metrics even further into types of signals to help you inform your marketing and sales strategies in the future:

Note: This section is relevant for folks interested in or current users of TAM Signals, a new Buyer Intent add-on that allows access into intent data for categories you’re not currently listed in. If this sounds interesting and relevant to you, keep on reading! If not, feel free to hop down to Book 9.

In this section, we’ll provide an overview of TAM (Total Addressable Marketplace) Signals, what the specific signals indicate, and ways you can think about marketing, sales, and product(!) efforts for a couple of specific use cases.

TAM Signals enable you to access G2 Buyer Intent data for categories that you’re not currently listed in but are relevant to you.

TAM Signals packages include the following signals for a specific category:

| G2 Tam Signals Glossary: What am I seeing? |

| Category Visit: A Buyer who visited the category of which you selected to access TAM Signals (the name of the category will be displayed to differentiate from other categories you’re in). |

| Alternatives Visit: A Buyer who visited an Alternatives page of anyone in the category of which you selected to see TAM Signals. |

Below are a couple of scenarios to give you an idea of the potential ways TAM Signals can be leveraged. There are a ton of other use cases for TAM Signals, this is just the start!

Scenario #1: You’re a services provider for companies that purchase a specific category’s products.

As a partner, agency, or consultant, you’ll likely not fit into a relevant category of your own, but you know you fit really well within certain buying journeys and purchases of products. TAM Signals enable you to access category and alternative Buyer Intent signals for categories where your target buyers are visiting, exploring, and purchasing.

Scenario #2: You’re planning or vetting possible entry into a new category with a new product offering.

You might want to gain insights and get an idea of the audience and market landscape ahead of a new product launch into that category or you’re exploring whether you want to build a product within the category. TAM Signals enable you to access category and alternative Buyer Intent signals for categories where your target buyers are visiting and exploring.

Scenario #3: You’re typically considered when a buyer is looking at a specific type of product/category.

Perhaps you’re a company that needs to be used in conjunction with another main type of software or you’re a software solution that complements a purchase of a software in another category TAM Signals enables you to access category and alternative Buyer Intent signals for the categories where your target buyers are visiting and exploring.

There’s a ton you can do to leverage TAM Signals and help them reach your broader business goals. This is just the start!

Just kidding, we’re all done! No more books! We’ve made it through a hypothetical 3,407 page journey, together.

Like Harry Potter, this guide is great to come back to visit if you’re looking to add a new G2 Buyer Intent-focused audience to your marketing and sales efforts or if you need a refresher on one of the books.

We hope you found this series helpful! If you have any feedback, please let us know. What additional Buyer Intent info and best practices do want? We’re sure there are more chapters to be written.

Let your G2 rep know!

Kaitlyn is the former Sr. Product Marketing Manager at G2.com. Originally from Des Moines, Iowa, Kaitlyn made the move to Chicago nearly a decade ago. She’s also worked at other leading Chicago tech companies including Solstice | Kin + Carta and PowerReviews.

Quick - jot down everything you know about your prospective buyers.

Software buyers are researching, comparing, and making decisions based on the social proof and...

Congrats, you won a new customer! Don’t breathe a sigh of relief just yet.