The CEO Playbook Part 2: Scale Your Business and Sustain Success

Pop quiz: 43% of small businesses claim their biggest financial challenge is ________.

August 31, 2021

by Brittany K. King

by Brittany K. King

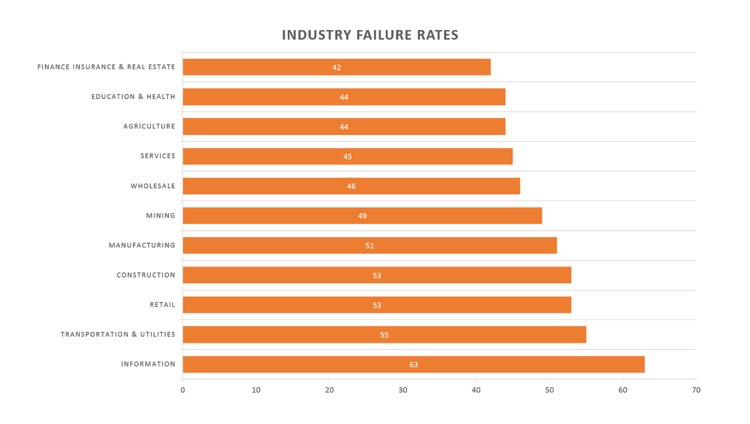

Sixty-three percent of tech startups fail in the first four years - the highest failure rate of any industry, believe it or not.

Hold on, technology is the largest market in the world. Certainly dipping your toes in the tech sphere is a surefire way to guarantee business success… right?

Starting a company isn’t easy, even in a mammoth market. Business is demanding, intimidating, and unpredictable. And just because your feet are off the ground doesn’t guarantee you’re in for smooth sailing.

Source: Failory

But here’s some more hopeful data worth reaching for: $1 billion valuation from nothing, 100% year-over-year growth, and number one software category leader. These numbers aren’t just reserved for the once-in-a-lifetime venture. In fact, a good number of tech leaders are seeing numbers like this right now.

G2’s recent webinar, The CEO Consult, is chock-full of proven strategies from three of tech’s most successful CEOs to help promising software ventures become the next “best of” unicorns in their space.

In one hour, GoCardless’ Hiroki Takeuchi, Chargebee’s Krish Subramanian, and G2’s own Godard Abel opened up about what worked, what didn’t, and how they avoided that dreaded 63% failure rate in their collective 80+ years of entrepreneurship.

Ready to take their advice and spin it into actionable items you can implement today? Below we’ll break down, step-by-step, how to not only avoid becoming another failed startup statistic, but how to go beyond your product with customer-led growth to drive near-term victories and lasting, long-term success.

In part one of this playbook, you will learn how to:

It’s no secret that there is a crisis of trust between modern consumers and businesses. The never-ending news cycle, access to information (and misinformation), and changes in societal values have all influenced how buyers make purchasing decisions.

On top of that, the massive shift to remote work and digital communication has made earning trust all the more difficult. So without the ability to have physical interactions with a salesperson, how are companies expected to gain buyers’ trust?

The answer is simple: let your customers do it for you using a customer-led growth strategy.

of businesses believe they are delivering a “superior” customer experience, yet only 8% of customers agree.

Source: Growth Sandwich

Product-led growth (PLG) is when acquisition, expansion, and retention are driven by a company’s product. This means company-wide initiatives across all departments are centered around the product as the source of sustainable and scalable growth.

Take Slack, for example. As the fastest-growing SaaS company of all time, Slack grew from a $0 to $4 billion valuation in just four short years. Slack took a basic business need - internal communication - and created a product experience that put its competitors to shame. Their freemium growth strategy attracted potential users with free limited access, while the product experience ultimately encouraged upgrades.

Put simply, brands that drive a PLG strategy believe their product speaks for itself. These companies ultimately want prospective users to trial their product, usually for free, rather than immediately funneling them through a sales cycle.

Customer-led growth (CLG), on the other hand, puts customer insights first. Companies utilize these insights to qualify and quantify the value of a customer. From there, brands can create and continuously improve upon their customer experience.

Brands that implement a CLG strategy not only care about customer sentiment but also about how they can develop and produce a product that specifically addresses customer pain points and helps users reach expected outcomes.

Domino’s 2010 Pizza Turnaround campaign, driven by negative customer reviews, is a master class in CLG. Through this campaign, the company created a transparent line of communication with their customers and openly acknowledged critical comments that littered their online reviews, including “[my] pizza was cardboard” or “microwave pizza is far superior”.

Instead of quietly working on their product behind the scenes, Domino’s concentrated on their customers’ sentiment to directly tackle the problems at hand. Domino’s was able to rescue their near-failing business by acknowledging their customers’ negative feedback and resolving those issues openly.

Customer-led growth strategies are all about collecting, ingesting, and sharing user experiences, to both improve the product and establish lasting trust with your market. And the only way to succeed with CLG is by understanding your users’ values and using those insights to drive business operations.

Why is customer-led growth the way of the future?

Implementing a CLG strategy means you are providing value to your customer throughout the lifetime of the relationship. With CLG, you don’t need to solely rely on the sales team to drive a growth strategy. You also don’t need to hope that new product features alone will drive purchase upgrades (let’s be honest, we’ve all signed up for the 7-day trial of HBO Max only to cancel without providing feedback as to why).

Customer-led growth breaks the customer relationship down into stages based on the customers’ success milestones rather than business metrics. Gaining clarity on and operationalizing how customers receive value and achieve goals with your product will inspire others to see how they could use your product to reach their own.

Customer insights help product teams understand the features users care about most and help marketing teams learn the specific language customers use to talk about their pain points. These insights bring brands closer to their users so they can engage, retain, and help their customers succeed.

Today’s buyers don’t trust easily. Your customers want to feel confident that your product will solve specific pain points and help them achieve their goals. A true CLG strategy considers the needs of the customer and ensures the product mirrors those sentiments.

of customers say the experience a business provides is just as important as the products or services they sell.

Source: Salesforce

Entrepreneurs thrive in the what. As a visionary, you see opportunities to solve problems before most of us even know those problems exist. This unique lens on the world is your strong suit. However, most entrepreneurs fall short on tactically executing this vision - and the most common miss is timing.

Getting the idea right is only half the battle. If you fail at timing your idea might be too late, too soon, or (worst case scenario) stolen by another visionary who beat you to the punch. A lot is at risk when launching a business, and you should not only feel confident in your idea, but also prepared for the inevitable changes, setbacks, and failures to come.

Entrepreneurship is not black and white. Hiroki Takeuchi explains: “For me, [there] are two very distinct questions: one is ‘When are you ready to start?’ and the other ‘Is this idea the great one?’”

Hiroki Takeuchi

Co-founder and CEO, GoCardless

But some things are certain: you need a solid foundation to build your business upon - one that’s strong enough to tackle challenges, but flexible enough to allow you to adapt. Below are the four things you need to complete before starting your business.

Whether your product is in development or yet to be created, you already have a handle on what you will be selling. Research what industry leaders are currently doing and learn about their pathway to success. Make note of things they do well and areas where they struggle (hint: this is your sweet spot).

Identify how your product differentiates from competitors and center your narrative around why it will add more value to potential customers. Knowing your product’s differentiators will help you create a business plan.

If you feel stuck, take a step back and ask “why?”:

If you can’t answer these questions, it’s time to go back and refine your product idea until you can.

Tip: Not sure where to start? Ask! Your customers and potential buyers are a wealth of information just waiting to be tapped into. Leverage channels like G2 to see exactly what the market has to say about your competitors to drive your refinement process.

You can’t sell a product if you don’t know who you’re selling to. Understand the problem your product is solving and work backward to figure out exactly who will benefit from your solution.

Don’t take the easy way out. If your product is a marketing solution, for instance, your target audience isn’t just marketers. The answer should include specific job titles within a specific specialty, within a discipline, within a market, or within a vertical. The more focused your audience becomes, the more personalized, prescriptive, and resonant your messaging will be for your buyers.

But finding your audience is not enough. You also need to get inside the mind of the customer by conducting thorough market research. This research will help you better understand potential audiences you may not have considered, including their unique needs and goals in their specific roles, as well as their behaviors and preferences.

You can uncover specifics about your future customers in the following ways:

of failed startups say that misreading market demand was the number one reason they went under.

Source: Embroker

Funding a startup feels like a race against the clock. What’s going to come first: solvency or profitability?

Any amount of outside investment seems like a big push in the right direction, but don’t forget: 63% of tech startups fail. You need to make sure profitability wins the race.

Before you solicit investors or tap into your savings, perform a break-even analysis. A break-even analysis tells you how many products or units need to be sold to cover both fixed and variable business costs.

This will help you predict when your company will make money so you don’t have to worry each month about running out of cash and instead, focus on the fun stuff: the product, the customers, and the market.

Break-even point = fixed costs ÷ (average price - variable costs)

So you’ve performed a break-even analysis and have a number in mind - where’s the best place to start acquiring funding? There are various ways to finance a business and many entrepreneurs utilize a combination of these methods to acquire startup capital and hedge their funding bets.

These funding methods may depend on factors such as your location, type of business, personal creditworthiness, and the amount needed. But by using multiple methods at once, you can ensure your business doesn’t have a single point of failure, reducing the likelihood of one channel completely wiping out your business.

You can apply for a commercial loan through any major bank. Alternatively, you can see if you qualify for a loan with the U.S. Small Business Administration (SBA).

Benefit: The bank cannot dictate your business operations, meaning you are in complete control of how to spend the money acquired from your loan.

Sacrifice: You’re beholden to the often inflexible and non-negotiable bank terms and conditions, including your interest rate and payback schedule.

Individuals or organizations can act as investors in your business. Bringing in investors is a good way to secure a lot of funding up front.

Benefits: You don’t have to pay interest on an investor’s contribution, nor do you need a proven credit history to acquire it. Working with investors gives you direct access to their expertise.

Sacrifice: Investors are involved with business operations, so you may not have as much control. You’ll also ultimately reduce your earnings, as investors continue to earn profit after their contribution has been paid back.

A business grant is similar to a loan but does not need to be repaid. Grants may come with specific requirements your business must meet in order to qualify.

Benefits: You do not have to pay back a grant. Business grants help spread awareness about your venture and provide a level of credibility for future funding endeavors.

Sacrifice: Grants can be difficult to acquire since there is a lot of competition and strict requirements. Businesses that receive grants have to follow a contingency plan and be specific about how the money is spent.

Equity crowdfunding is when you raise small amounts of money from a large number of people. You can crowdfund in-person or on the internet.

Benefit: There is low financial risk with crowdfunding. You won’t have to pay interest, meet strict requirements, or give up equity to your backers.

Sacrifices: Crowdfunding campaigns are a slow burn and take time to gain traction. And since crowdfunding platforms are public, it gives other entrepreneurs visibility into your business plan.

Tech company startup costs vary and depend on factors like product offerings, resources available, and rate of growth. However, you can predict some costs based on these stats:

$1 billion valuation, 100% year-over-year growth, the number one software category leader - these numbers are attainable for businesses that lay a strong foundation and let their customers’ voice drive their strategy.

Now that your company is off the ground, it’s time to find the right support so you can expand operations. Learn how to scale your business and sustain lasting success in part two of The CEO Playbook.

Reach your next PEAK.

Reach your next PEAK.

Scale your business and sustain success. Learn how to expand operations in part two of The CEO Playbook.

Brittany K. King is a former Content Marketing Manager at G2. She received her BA in English Language & Literature with a concentration in Writing from Pace University. Brittany’s expertise is in supporting G2 products and sellers, focusing specifically on Buyer Intent data and Review Generation. After 5pm, you can find Brittany listening to her extensive record collection, hanging with her dog and cats, or booking her next vacation.

Reach your next PEAK.

Reach your next PEAK.

Scale your business and sustain success. Learn how to expand operations in part two of The CEO Playbook.

Pop quiz: 43% of small businesses claim their biggest financial challenge is ________.

Quick - jot down everything you know about your prospective buyers.

Congrats, you won a new customer! Don’t breathe a sigh of relief just yet.